Oh my Satoshi

2017-15

2017: Craig is back!

Craig Wright couldn't prove he invented Bitcoin, but "in the last six months, Wright has returned to the world of Bitcoin with a vengeance. He is the Chief Scientist of a new Bitcoin research company called nChain, which has already filed numerous patents for Bitcoin technology. He tweets with unrestrained contempt for his perceived enemies in Bitcoin. He gives talks at conferences for the online gambling industry while wearing sunglasses indoors."

quoted from:

Craig Wright Couldn’t Prove He Invented Bitcoin, But He’s Back Anyway

Oct 20 2017

→ https://motherboard.vice.com

How The Banks Bought Bitcoin

The truth about the lightning network

Published on 15 Dec 2017

by Decentralized Thought

Some thoughts about the possible Bitcoin Segwit, Bilderberg/AXA/BockStream/Core, In-Q-Tel, CIA connection.

Posted by u/cryptorebel/ in r/btc on 15. November 2017

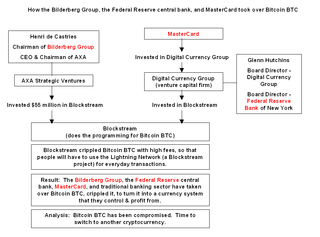

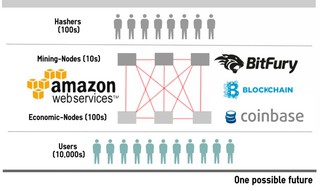

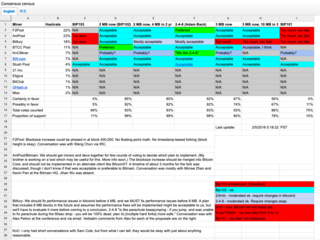

I noticed a lot of people mentioning Bilderberg's connection to AXA and BlockStream, recently with Jeff Berwick's two videos going viral as seen here and here. It has been something I have been trying to warn people of for a while, and if you don't know what Bilderberg is you really need to watch this excellent documentary about it. The current chairman of the Bilderberg steering committee Henri de Castries was also CEO of AXA until he announced retirement in 2016. AXA is one of the main funders of BlockStream and Bitcoin Core development. As one of the biggest insurance companies in the world AXA also benefits from the legacy too-big-to-fail bailout system, and Bitcoin is a threat to their way of life. AXA are also funding technocratic totalitarian smart cities, where they team up with governments for full control. It is not surprising that they would want to get their fingers into Bitcoin.

Now lets dig a little deeper. About 6 or 7 years ago, right before Satoshi disappeared, Gavin Andresen was invited to speak at the CIA. He got an invitation directly from In-Q-Tel the CIA's venture capitalist funding arm. Gavin mentions how In-Q-Tel reached directly out to him in this video @ 13sec mark (I am not endorsing the rest of the content of this video). In-Q-Tel basically helps fund and invest in companies that help equip the CIA with the latest information technology and capabilities. You can look on In-Q-Tel's website and see that they publicly invest in many innovative tech companies. Some of these are public, there are no crypto companies listed, but they also at times make private investments as well. Makes you wonder because they were interested enough to phone up Gavin Andresen personally and invite him for a speech, so in my opinion its highly likely they are investing somewhere in this space, and for what ends? We don't know. We do know that certain companies have captured the Core developers, and blocked common sense progress on Bitcoin, and that should be alarming.

Further evidence that shows some type of coordination between these groups comes from Peter Thiel who has recently advocated against Bitcoin as a cash system, and instead is pushing it as a settlement system, the same narrative of BlockStream Core. It may also be interesting to know that Peter Thiel has also attended Bilderberg regularly and defends Bilderberg's secretive nature. Thiel also is partnering with In-Q-Tel and the CIA with his company Palantir, which spies on everybody. It is also interesting that at least one other VC funding firm Khosla Ventures invested in BlockStream, and also in the past has helped fund other companies that are working with In-Q-Tel. This was just from some quick research, only scratching the surface.

I find these connections somewhat alarming, considering all of the community attacks I have seen going on. Its possible that some groups are trying to strangle and control and co-opt Bitcoin. It would make sense that they might try to force everyone off of the old model by jacking up fees, so users are herded onto something new in a 2nd layer solution that is more easily controlled. I believe segwit allows them to create an open door for trying to encourage Bitcoiners to move into their system, and the high fees is what they hope pushes users through that door. This is probably why we see so many attempts to move away from Satoshi's vision and the whitepaper. Its why we see such a lack of common sense to simply raise the blocksize capacity. Its why we see such draconian censorship, dirty tricks, lies, and diabolical political tactics. Ultimately I don't want to draw any final conclusions, but I feel these facts should be brought to the table for people to decide for themselves.

Source: reddit.com

How bitcoin is changing the world

Andreas Antonopoulos' talk at Internetdagarna 2017

A Bitcoin based future — Hording, equity, and the end of debit and credit.

This speech was given at the Bitcoin Meetup Switzerland 2017 held in Zurich on October 24, 2017.

What is true Bitcoin and its future potential?

Dr. Craig Wright at a conference for financial engineering students at ESILV

September 2017

Craig Wright explains why a Japanese name was used as the inventor of bitcoins

Future of Bitcoin Conference in Arnhem, Netherlands

June 30 2017

Craig Wright asked about why the fake Satoshi proof

June 30 2017

Big Blocks Can Scale | But Will It Centralize Bitcoin?

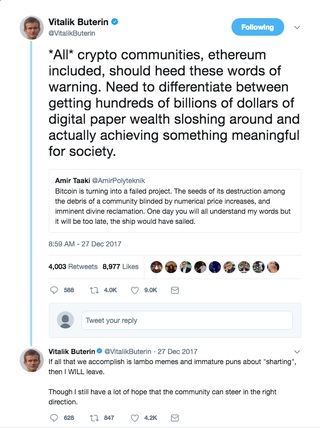

ETHEREUM: The Good, The Bad, and The Ugly!

Ethereum, being touted as a "better Bitcoin," is set to takeover as the leading main cryptocurrency. But what kind of money is behind Ethereum, and where might these nascent technologies eventually take us?

Published on Jun 15, 2017 by FaceLikeTheSun

An Open Letter to Bitcoin Miners

by Jonald Fyookball, May 14, 2017

Dear Bitcoin Miner,

My name is Jonald, and I am a Bitcoin investor.

I bought my first Bitcoins in 2013 and have been active on the Bitcointalk forum since March, 2014. I’m also a small business owner that actually uses Bitcoin for remittance payments, and I hold a degree in Computer Science.

Since Bitcoin investors and miners need each other to succeed, I wanted to take a minute to reach out to you, and send a sincere message from a “real Bitcoiner”.

I’ll cut right to the chase:

I’m concerned. I believe we urgently need to find a scaling solution, and I believe the best solution is to increase the blocksize.

At least, hear me out.

Read on

Source:

https://keepingstock.net/an-open-letter-to-bitcoin-miners-c260467e1f0

"They dressed me in a bloody turtle neck! [...]

I have NEVER worn a frikin turtle neck in my life. Like I was bloody jobs or something."

MAY 4TH, 2017

Craig Wright Q&A on Slack

tomtomtom7 [9:09 AM]

csw: Sorry if blunt, but could you comment on why you let Gavin vouch for you without going public with proof yourself?

csw [9:10]

Tomx3+7, I had never wanted what occured and I had no plans to be an authority. I will not

csw [9:11]

I will be a scammer with ideas that go to market before I become something I detest and people wanted that. They dressed me in a bloody turtle neck!

csw [9:12]

I have NEVER worn a frikin turtle neck in my life. Like I was bloody jobs or something.

csw [9:12]

I made stupid decisions and I, as all do, have regrets.

csw [9:13 AM]

I am not good with people. This is difficult for me now. Vlad and others have pushed me to be here and to be frank it scares the shit out of me

csw [9:27 AM]

I am not going to play Satoshi. I am not wanting to have people think I am and I am going to imagine that nobody ever doxx'd me and that I am just some overqualified academic for the moment... ok?

Source:

https://pastebin.com/zU6YZWXK

GOOGLE’S SELFISH LEDGER IS AN UNSETTLING VISION OF SILICON VALLEY SOCIAL ENGINEERING

Published by Vlad Savov on May 17, 2018

This internal video from 2016 shows a Google concept for how total data collection could reshape society:

Google Selfish Ledger is a 2016 video made inside the company that imagines a world where the company had so much data, it could map human behaviors, social issues, mental illness, and more. It's a frightening, dystopian idea that feels part of a sci-fi movie. Here's what it actually says about Google and Silicon Valley at large.

The video was made in late 2016 by Nick Foster, the head of design at X (formerly Google X) and a co-founder of the Near Future Laboratory. The video, shared internally within Google, imagines a future of total data collection, where Google helps nudge users into alignment with their goals, custom-prints personalized devices to collect more data, and even guides the behavior of entire populations to solve global problems like poverty and disease.

Read On

Source:

Verge.com

The “Internet of Transactions”

Our vision is to transform how the world conducts all transactions – using the blockchain’s distributed, decentralised ledger that chronologically records transactions in an immutable way.

Working to build this new world, our mathematicians, scientists and engineers are enhancing our advanced portfolio of tools, protocols and applications. These innovations will accelerate blockchain adoption across a range of industries, from financial and legal services to entertainment and media.

We are realising this vision today. We’re about to change everything.

https://nchain.com

nChain Chief Scientist Dr. Craig Wright speaks about how Threshold Signatures and advanced technology can power Bitcoin's greater future. He discusses some of nChain's research and innovation work to support growth of the bitcoin network for everyone's benefit, and dares the bitcoin community to dream of a greater future for bitcoin.

This speech was given at Bitkan's "Shape the Future" Blockchain Global Summit - Tech Session in Hong Kong (September 21, 2017)

In Defense of Craig Wright - Part 1

Posted by belerophon on steemit in 2017

Many have watched the Bitcoin segwit debate with interest over the past year. Last weekend it got a lot more interesting with Craig Wright’s declaration of war on segwit, in a presentation he made at the Future of Bitcoin Conference.

Transcript

What Dr. Wright showed us in his lecture is that he certainly is no Cicero. He is not gifted in the art of oration. At points in the lecture he came across as frustrated, passionate and a bit angry. Some have even said he was unhinged, and that he threatened the Bitcoin community.

But if you take the time to read the transcript of what he actually said, it is entirely consistent with his claims from 2016. And more importantly, his comments were congruent with someone who was at the very least one of the very earliest developers of Bitcoin, and who is frustrated with the direction that has been taken by the Bitcoin Core, and especially the segwit proposal. I will take apart his comments further down.

Many in the Bitcoin community have ridiculed Wright as a fraud and a conman, and therefore dismiss his technical arguments about the segwit question out of hand. I am not saying that he is not a fraud and a conman. For all I know, he may very well be a fraud and a conman in the way he has treated people in the past, but not on the particular point of whether he is/was Satoshi. However, I have no such first-hand knowledge of his personal dealings. And he has never been charged by a court with fraud. So to publicly call him a conman or fraud is defamation apart from a court finding.

Read on

Source:

steemit.com/bitcoin/@belerophon

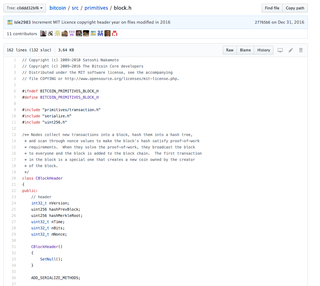

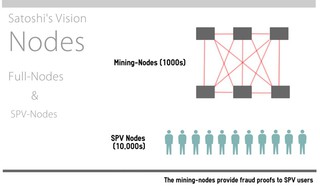

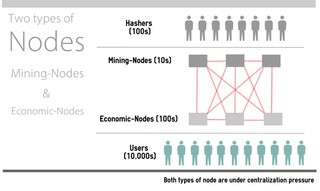

Why “non-mining full nodes” are a terrible idea.

by Olivier Janssens, Aug 22, 2017

In the early days of Bitcoin, there was no-such thing as a “non-mining full node”. Every miner was a node and every node was a miner. In Bitcoin’s whitepaper, the word “node” = miner.

‘As long as a majority of CPU power is controlled by nodes (miners) that are not cooperating to attack the network, they’ll generate the longest chain and outpace attackers.’

It wasn’t until a couple of years ago, that people started using the “full node” term in a non-mining sense. Unfortunately there has been a huge amount of propaganda that “Everyone should be able to run a “non-mining full node””. This has always baffled me because that’s a really terrible idea!

Arguments FOR running a “non-mining full node”

I will list the most cited arguments, and then give my rebuttal.

Read on

Source:

https://medium.com/@olivierjanss/...

August 11, 2017, 11:36:00 AM

by CipherionX

I'm in the process of developing a website dedicated to early bitcoin history. Mike Hearn was gracious enough to contribute to the project by sharing his e-mail conversations with Satoshi. Since these are never-before-seen writings of Satoshi, I thought others would enjoy having access to them now, rather than waiting for the website to go live.

Here they are:

https://pastebin.com/Na5FwkQ4

https://pastebin.com/cKZPC1rF

https://pastebin.com/wA9Jn100

https://pastebin.com/JF3USKFT

https://pastebin.com/syrmi3ET

If anyone else has anything they would like to share from early bitcoin times (2009-2010), please e-mail me at CipherionX@protonmail.com

Thanks!

-CipherionX

https://bitcointalk.org/index.php?topic=2080206.0

Have you heard of Phil Wilson "Scronty?" Imo either the greatest Bitcoin hoax ever or he was really working with CSW and Dave Kleinman together as "Satoshi Nakamoto": http://vu.hn/bitcoin%20origins.html …

Bitcoin’s Smart Future: Artificial Intelligence, Intelligent Bots & How The Bitcoin Network Will Change the World

Dr. Craig Wright at iGaming Super Show.

July 13 2017, Amsterdam

Craig Wright lays out amazing deep wisdom at the Future of Bitcoin conference in Arnhem, Netherlands.

June 30 2017.

Open the Kimono, Satoshi

Ian Grigg from financialcryptography.com

May 04, 2017

We may as well get it all off the chest and move on. Let's open the kimono, let's do a little reveal (!) and *let's move on folks*.

When I said that Craig was part of the team that was Satoshi Nakamoto - that statement sort of hung there and became an urban legend. You might recall that I made that statement in May of 2016, but within days, the events went out of control and it all collapsed.

So I pulled out of the discussion - privacy, remember? Meanwhile, the statement was never retracted. Outrage! So, in scandal piled on trauma lumped on insult and infamy, today, the statement isn't being retracted, again.

Instead I'm here to report that Satoshi Nakamoto is dead. It's all over folks.

RIP Satoshi Nakamoto 2005 - 2016

But, now that it's all over, let's put some facts down so we can all properly grieve for the passing.

RIP Satoshi Nakamoto. Harken back a year or two.

The assassination of Satoshi Nakamoto started around mid 2015 with several episodes, some of which I reported at the time. But I didn't hear details of the gathering coup de grace, the 'big reveal', until end 2015. To be honest, I and others briefed always expected this to be a disaster; I well remember my good friend and shepherd JVP saying on a conference call to the circus ringmeisters "Since you turned up, everything has gone to sh*t."

The reason was the publicity team - they had little clue as to who/what/when they were dealing with, and their starry eyes were blinded by $$$ dollars.

The reason was the publicity team - they had little clue as to who/what/when they were dealing with, and their starry eyes were blinded by $$$ dollars.

When I asked him the point of the whole exercise he said it was simple: ‘Buy in, sell out, make some zeroes.’

FFS. They, arrogant ringmasters that they were, were also not capable of taking criticism and dealing with people who wanted to help and knew the scene, a flaw that eventually brings down even the bestest and most spirited.

The practical mistake of the May 2016 Circus known as nCrypt was to set up a sort of London pop star roadshow with BBC, big name journalists, authors of famous books, the media team behind David Bowie and dozens of other frills and press releases.

Just because, right? And as a sort of hand wave to the community, they contacted some big names. Many of whom smelled a rat and stayed away, in retrospect decisions of wisdom.

I point this out as the first fact: the ringmasters really fooked the circus. Do you feel my anger? That needs to be understood, first and foremost, in all that relates to the death of Satoshi, May 2016.

The Big Fubar

Now, the next question, in light of the circus fubar is the phenomenal response of the community. *People demanded proof.* "Pix, or it didn't happen." Which is kind of weird because we live in a post-truth world now, and everyone knows pix can be faked. I mean, read the political news, people!

And so it is with cryptography. As I outlined on the metzdowd cryptography list at the time, no signature will be proof:

The technical argument is simple, so I'll repeat the governance story quickly: The keys were moved very early in the piece to a safe set of hands (like, around 2009, I don't know for sure, I wasn't there), because the original set of hands was now in danger, which you can confirm if you read all the published documents. Then a bit later on, the keys were moved again to another set of safe hands (maybe 2013). And finally, they were moved yet again.

I wasn't there except for the last move, and even that not physically but net-wise. I can tell you that (a) it happened and (b) it was traumatic. Don't be around when that happens. Really, don't. More on that below.

→ read on

Ian Grigg: Ricardian Contracts And Digital Assets Prehistory

Published by Epicenter Podcast on 04.10.2016

Money, blockchains, and social scalability

Published by Nick Szabo on February 09, 2017

Blockchains are all the rage. The oldest and biggest blockchain of them all is Bitcoin, which over its eight-year history so far starshipped in value from 10,000 bitcoins per pizza (before there were exchanges that priced bitcoin in traditional currencies) to over $1,000 per bitcoin. As of this writing Bitcoin has a market capitalization of over $16 billion. Running non-stop for eight years, with almost no financial loss on the chain itself, it is now in important ways the most reliable and secure financial network in the world.

Read on

Source:

unenumerated.blogspot.com

A Journey to the Moon,

Bitcoin as a World Currency

Presentation by Amaury Sechet on November 30th 2016 at OnChain Scaling Conferences #3 - The Future of Bitcoin.

Source:

www.onchainscaling.com

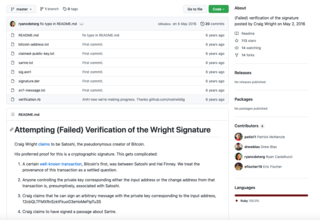

Why Craig Wright's Satoshi Nakamoto proof failed

Andrew O'Hagan discusses his article on Craig Wright's attempt to prove he is Satoshi Nakamoto, the creator of Bitcoin.

Published on Jun 28, 2016

by London Review of Books (LRB)

The "Sartre" file

totally-not-sartre.txt

$ bitcoin-cli decoderawtransaction 0100000001ba91c1d5e55a9e2fab4e41f55b862a73b24719aad13a527d169c1fad3b63b5120100000043410411db93e1dcdb8a016b49840f8c53bc1eb68a382e97b1482ecad7b148a6909a5cb2e0eaddfb84ccf9744464f82e160bfa9b8b64f9d4c03f999b8643f656b412a3acffffffff0200ca9a3b00000000434104bed827d37474beffb37efe533701ac1f7c600957a4487be8b371346f016826ee6f57ba30d88a472a0e4ecd2f07599a795f1f01de78d791b382e65ee1c58b4508ac00d2496b0000000043410411db93e1dcdb8a016b49840f8c53bc1eb68a382e97b1482ecad7b148a6909a5cb2e0eaddfb84ccf9744464f82e160bfa9b8b64f9d4c03f999b8643f656b412a3ac0000000001000000 { "txid": "112565f6f7ab09154ddecda36a84b27ed0faaa123647ae2ab09189bbf7b63c01", "size": 270, "version": 1, "locktime": 0, "vin": [ { "txid": "12b5633bad1f9c167d523ad1aa1947b2732a865bf5414eab2f9e5ae5d5c191ba", "vout": 1, "scriptSig": { "asm": "0411db93e1dcdb8a016b49840f8c53bc1eb68a382e97b1482ecad7b148a6909a5cb2e0eaddfb84ccf9744464f82e160bfa9b8b64f9d4c03f999b8643f656b412a3 OP_CHECKSIG", "hex": "410411db93e1dcdb8a016b49840f8c53bc1eb68a382e97b1482ecad7b148a6909a5cb2e0eaddfb84ccf9744464f82e160bfa9b8b64f9d4c03f999b8643f656b412a3ac" }, "sequence": 4294967295 } ], "vout": [ { "value": 10.00000000, "n": 0, "scriptPubKey": { "asm": "04bed827d37474beffb37efe533701ac1f7c600957a4487be8b371346f016826ee6f57ba30d88a472a0e4ecd2f07599a795f1f01de78d791b382e65ee1c58b4508 OP_CHECKSIG", "hex": "4104bed827d37474beffb37efe533701ac1f7c600957a4487be8b371346f016826ee6f57ba30d88a472a0e4ecd2f07599a795f1f01de78d791b382e65ee1c58b4508ac", "reqSigs": 1, "type": "pubkey", "addresses": [ "1ByLSV2gLRcuqUmfdYcpPQH8Npm8cccsFg" ] } }, { "value": 18.00000000, "n": 1, "scriptPubKey": { "asm": "0411db93e1dcdb8a016b49840f8c53bc1eb68a382e97b1482ecad7b148a6909a5cb2e0eaddfb84ccf9744464f82e160bfa9b8b64f9d4c03f999b8643f656b412a3 OP_CHECKSIG", "hex": "410411db93e1dcdb8a016b49840f8c53bc1eb68a382e97b1482ecad7b148a6909a5cb2e0eaddfb84ccf9744464f82e160bfa9b8b64f9d4c03f999b8643f656b412a3ac", "reqSigs": 1, "type": "pubkey", "addresses": [ "12cbQLTFMXRnSzktFkuoG3eHoMeFtpTu3S" ] } } ] } $ echo 0100000001ba91c1d5e55a9e2fab4e41f55b862a73b24719aad13a527d169c1fad3b63b5120100000043410411db93e1dcdb8a016b49840f8c53bc1eb68a382e97b1482ecad7b148a6909a5cb2e0eaddfb84ccf9744464f82e160bfa9b8b64f9d4c03f999b8643f656b412a3acffffffff0200ca9a3b00000000434104bed827d37474beffb37efe533701ac1f7c600957a4487be8b371346f016826ee6f57ba30d88a472a0e4ecd2f07599a795f1f01de78d791b382e65ee1c58b4508ac00d2496b0000000043410411db93e1dcdb8a016b49840f8c53bc1eb68a382e97b1482ecad7b148a6909a5cb2e0eaddfb84ccf9744464f82e160bfa9b8b64f9d4c03f999b8643f656b412a3ac0000000001000000 | xxd -r -p | sha256sum 479f9dff0155c045da78402177855fdb4f0f396dc0d2c24f7376dd56e2e68b05 -

https://gist.github.com/ryancdotorg/893815f426f181d838c1b44aa187f05a

from https://rya.nc/sartre.html

"Satoshi Nakamoto is not really a man; he is a manifestation of public acclamation, an entity made by technology, and a myth. Old-fashioned journalism might bring you to him – or cause you to miss him altogether – but he was born of relationships that depend on concealment. A reporter was once a person who could rely on visible evidence, recordings, notes, statements of fact, and I gathered these assiduously, but this was a story that challenged the foundations on which reporting depends. I fought to uphold familiar standards of truth, and fought to discover new ways to uncover it in this underworld of companies with a vested interest in disclosing some things but not others, but it felt like the walls of virtual reality were forever pressing in on my notepad."

Andrew O’Hagan

Source:

The Satoshi Affair

Andrew O’Hagan on the many lives of Satoshi Nakamoto

http://archive.is/kjuLi#selection-1623.0-1623.16

May 1, 2016 by Satoshi Nakamoto

“If I sign myself Jean-Paul Sartre it is not the same thing as if I sign myself Jean-Paul Sartre, Nobel Prizewinner”

– Jean-Paul Sartre, 1964

I remember reading that quote many years ago, and I have carried it with me uncomfortably ever since. However, after many years, and having experienced the ebb and flow of life those years have brought, I think I am finally at peace with what he meant. If I sign Craig Wright, it is not the same as if I sign Craig Wright, Satoshi.

I think this is true, but in my heart I wish it wasn’t.

IFdyaWdodCwgaXQgaXMgbm90IHRoZSBzYW1lIGFzIGlmIEkgc2lnbiBDcmFpZyBXcmlnaHQsIFNhdG9zaGkuCgo=

I have been staring at my screen for hours, but I cannot summon the words to express the depth of my gratitude to those that have supported the bitcoin project from its inception – too many names to list. You have dedicated vast swathes of your time, committed your gifts, sacrificed relationships and REM sleep for years to an open source project that could have come to nothing. And yet still you fought. This incredible community’s passion and intellect and perseverance has taken my small contribution and nurtured it, enhanced it, breathed life into it. You have given the world a great gift. Thank you.

Be assured, just as you have worked, I have not been idle during these many years. Since those early days, after distancing myself from the public persona that was Satoshi, I have poured every measure of myself into research. I have been silent, but I have not been absent. I have been engaged with an exceptional group and look forward to sharing our remarkable work when they are ready.

Satoshi is dead.

But this is only the beginning.

Source:

→ complementarycurrency.org/jean-paul-sartre-signing-and-significance

Published by Jim btc on 05.05.2016

The incredible career of Craig Steven Wright — the Australian scientist who claims he created Bitcoin

Posted by Simon Thomsen at May 2, 2016, 10:30 AM on Business Insider Australia

In the early 1990s, long before he was suspected of being the elusive creator of the cryptocurrency Bitcoin, Brisbane-raised Craig Steven Wright worked as a saute chef, having trained in French cuisine.

He specialised in game meats and spent three years working with a catering company according to his lengthy and remarkable LinkedIn profile.

The hunt for the pseudonymous Satoshi Nakamoto, the supposed Bitcoin creator, saw global attention late last year focussed on Wright, along with a deceased American computer forensics expert Dave Kleiman.

Wright has now sensationally claimed he really is Nakamoto, having given access to a selected handful of media outlets and offered them proof of his ability to transact in Bitcoin using Nakamoto’s signature.

Business Insider interviewed Wright nearly two years ago when the CEO of Sydney tech company DeMorgan was getting ready open the world’s first Bitcoin-based bank, Denariuz. The company behind it, Hotwire PE, failed in 2014 and became the subject a dispute Australian tax authorities.

His career over the last two decades has been varied and tech-based, including a stint at a fledging internet business Ozemail, back when a future prime minister, Malcolm Turnbull, was a major investor in the business in the mid-90s.

Wright’s summary of his working life (which Business Insider accessed when it was public before the Nakamoto speculation reached fever pitch last year) ran to more than 2000 words on LinkedIn.

It showed attention to astounding detail, especially when it comes to listing achievements.

It’s the sort of CV that makes you wonder how the former high school student from Brisbane’s Padua Catholic College’s class of ’87 managed to fit it all in. In a black bow tie and jacket, his profile photo was reminiscent of James Bond. He cited News Ltd (now News Corp Australia), Vodafone, and Mahindra and Mahindra, India’s largest vehicle manufacturer, among his career consultancies, saying he was responsible for the creation of firewall and authentication procedure documents for News Ltd.

“Craig is one of the most highly qualified digital forensic practitioners globally. With over 10 years of direct digital forensic experience and more than 20 years in IT Security generally, Craig has not only worked to develop many of the techniques in common practice, but is also working to expand the field of knowledge,” one reference stated.

On LinkedIn he said:

Respected executive and technology leader delivering proven ability to capitalize on enterprise-level technologies and pioneering strategies. A sought-after internationally recognized author and public speaker, delivering solutions to government and corporate departments in SCADA security, Cyber Security and Cyber Defense, as well as leading the uptake of IPv6 and Cloud technologies. Drives innovative strategies that result in the strategic redevelopment and invigoration of both startups and established firms. Futurist, thought leader and expert with proven innovation in program leadership, execution design and strategic redevelopment.

Wright was a lecturer at Charles Sturt University for five years until June 2015, saying he “developed and promoted the Masters degree in Digital Forensics at CSU”, and now describes himself as a “multi-certified expert in enterprise security and cloud strategies”.

“I am a bit of an academic junkie and go from degree to degree as a sort of hobby, so this all adds to the level of being over-qualified for most things,” he said in a separate biography.

He’s gained a series of masters qualifications from different universities, but mostly CSU, where he also completed a doctorate in computer science in 2012.

Wright also cites a degree in international commercial law from Northumbria University, further qualifications from the University of Newcastle and is currently undertaking a Master of Science and Finance at University of London.

In addition to his consulting engagements he is also named as an author of several books and articles on digital forensics.

Dr Craig Steven Wright’s first PhD was in theology, achieved in 2003 with a dissertation titled “Gnarled roots of a creation theory”.

“If you need to ever need to know of Dionysus, Vesta, Menrva, Ceres (Roman Goddess of the Corn, Earth, Harvest) or other mythological characters – I am your man. I could even hold a conversation on Eileithyia, the Greek Goddess of childbirth and her Roman rebirth as Lucina,” he says on LinkedIn.

The former Catholic later became a trustee for the Uniting Church in NSW.

After school, Wright studied engineering at the University of Queensland, switching to computer science in his fourth year. He was working as a cook while simultaneously focussed on nuclear physics and nuclear magnetic resonance, then fuel sciences.

There was a stint at Corporate Express (formerly WPA) a Sydney business IT solutions company, around the same period, where he described his role as “general gopher and person people blamed when computers failed”, before the move to Ozemail in 1996 for a year “managing a bunch of engineers”. In April 1997 Wright says he moved to the Australian Stock Exchange for 14 months dealing with security and firewalls. During this time he was also studying fuel sciences.

In November 1997, he launched a Sydney-based company DeMorgan, apparently named after Augustus De Morgan, a 19th century British mathematician and logician.

DeMorgan is described as “a pre-IPO Australian listed company focused on alternative currency, next generation banking and reputational and educational products with a focus on security and creating a simple user experience”.

The business has more than a dozen companies focussed on crypto-currency under its umbrella, including his proposed bank, Denariuz, while others are directed towards online education.

Last year DeMorgan Ltd announced it had received $54 million under AusIndustry’s R&D Tax Incentive Scheme, which gives a cash rebate of 45 cents for every $1 spent on R&D.

The company’s goal was to have one of the top 20 super computers in the world and the fastest computer managed in the southern hemisphere. Wright announced a week after the R&D tax news that he’d personally run a free, five-week webinar course on supercomputers in conjunction with CSU.

He’s the author of several books, most recently the “The IT Regulatory and Standards Compliance Handbook”, and amid regular consultancies in digital forensics, was executive VP for strategic development at London’s Centre for Strategic Cyberspace + Security Science.

Another, more recent business, Hotwire Pre-Emptive Intelligence Group, has been less successful. Launched in June 2013, it was placed into voluntary administration less than 12 months later, with debts of more than $12.8 million.

Wright said the business aimed to “help the world to get ready for tomorrow today” and “inspire enduring optimism and trust”.

Its goal was R&D on e-learning and e-payment systems and software, acquiring software through a range of complex bitcoin-related transactions. Hotwire had 44 employees who were made redundant.

In December, Australian tax officials raided Wright’s home and office and as Business Insider revealed Hotwire has been involved in a bitter dispute with the ATO over tax claims. The company was issued with a $1.7 million penalty by the tax office. The business was a separate entity to DeMorgan.

One man who worked with Wright at Hotwire, Steven Lipke, is among 10 people who’ve posted testimonies for their colleague on LinkedIn.

It reads “Craig is a little bit crazy, as in Orville & Wilbur Wright craziness of deciding to add an engine to a glider. … a true visionary”.

This is an updated version of a story first published on December 10, 2015.

Read the original article on Business Insider Australia.

Mr Bitcoin: "I don't want money, I don't want fame!"

Published by BBC News on May 2, 2016

Australian entrepreneur Craig Wright has publicly identified himself as Bitcoin creator Satoshi Nakamoto. His admission ends years of speculation about who came up with the original ideas underlying the digital cash system. Mr Wright has provided technical proof to back up his claim using coins known to be owned by Bitcoin's creator. Prominent members of the Bitcoin community and its core development team have also confirmed Mr Wright's claim.

Source:

https://youtu.be/5DCAC1j2HTY

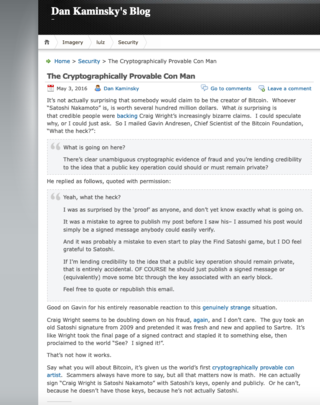

The Cryptographically Provable Con Man

May 3, 2016 Dan Kaminsky

It’s not actually surprising that somebody would claim to be the creator of Bitcoin. Whoever “Satoshi Nakamoto” is, is worth several hundred million dollars. What is surprising is that credible people were backing Craig Wright’s increasingly bizarre claims. I could speculate why, or I could just ask. So I mailed Gavin Andresen, Chief Scientist of the Bitcoin Foundation, “What the heck?”:

What is going on here?

There’s clear unambiguous cryptographic evidence of fraud and you’re lending credibility to the idea that a public key operation could should or must remain private?

He replied as follows, quoted with permission:

Yeah, what the heck?

I was as surprised by the ‘proof’ as anyone, and don’t yet know exactly what is going on.

It was a mistake to agree to publish my post before I saw his– I assumed his post would simply be a signed message anybody could easily verify.

And it was probably a mistake to even start to play the Find Satoshi game, but I DO feel grateful to Satoshi.

If I’m lending credibility to the idea that a public key operation should remain private, that is entirely accidental. OF COURSE he should just publish a signed message or (equivalently) move some btc through the key associated with an early block.

Feel free to quote or republish this email.

Good on Gavin for his entirely reasonable reaction to this genuinely strange situation.

Craig Wright seems to be doubling down on his fraud, again, and I don’t care. The guy took an old Satoshi signature from 2009 and pretended it was fresh and new and applied to Sartre. It’s like Wright took the final page of a signed contract and stapled it to something else, then proclaimed to the world “See? I signed it!”.

That’s not how it works.

Say what you will about Bitcoin, it’s given us the world’s first cryptographically provable con artist. Scammers always have more to say, but all that matters now is math. He can actually sign “Craig Wright is Satoshi Nakamoto” with Satoshi’s keys, openly and publicly. Or he can’t, because he doesn’t have those keys, because he’s not actually Satoshi.

Source: https://dankaminsky.com/2016/05/03/the-cryptographically-provable-con-man/

He’s Bitcoin’s Creator, He Says, but Skeptics Pounce on His Claim

Published on May 2, 2016 by The New York Times

By Paul Mozur and Nathaniel Popper

An Australian entrepreneur claimed on Monday to be the creator of the online currency Bitcoin. Within hours, the skepticism started.

Whether the truth is ultimately uncovered, the hunt for the founder’s identity is part of the new reality of the online age. A vast array of new tools and technologies make it ever easier to hide in the vast digital ocean that is the Internet — and all the more difficult to put a face to every screen name.

The identity debate is crucial for Bitcoin as those in the virtual currency community take sides over its direction. Some purists want to maintain Bitcoin’s outsider status, underscored by the mystique surrounding its founder. Others see an opportunity to expand Bitcoin into the commercial realm, making it more vulnerable to speculation and uncertainty.

Read on

Source:

nytimes.com

What is a “Full-Node” ?

There is a lot of talk of “full-nodes” in Bitcoin. They are apparently very important. From the day-to-day of my Twitter feed you would think there was a direct relationship between the number of reachable nodes on the network and Bitcoin’s health. This is wrong.

A full-node is a mining node.

A node:

Needs a complete, validated copy of the blockchain so that it can mine on the correct chain, earning bitcoins and contributing to the security of the network.

Chooses the transactions it includes in its blocks.

Relies on other mining nodes to accept its blocks as valid. Rejects any invalid blocks.

Won’t update its software unless it is sure it will generate blocks valid to the rest of the network

Will likely service requests for blockchain data and SPV clients

Bitcoin relies on a distributed network of these mining nodes, providing all the features we love about Bitcoin. Decentralization, security, censorship resistance and availability.

With a healthy distribution of mining nodes, SPV wallets become feasible, a user can ask the mining network for fraud proofs instead of downloading the entire blockchain. A user might trust a wallet service provider to provide blockchain data, it doesn’t really matter, the wallet service has no influence or bearing on the network. The mining nodes are the basis of the entire economy.

A full-node is a mining node.

Source:

https://medium.com/@shibuyashadows/wh...

Satoshi is dead - long live Satoshi - team leader comes out

Craig Wright has just outed himself as the leader of the Satoshi Nakamoto team.

I confirm that this is true, both from direct knowledge and a base of evidence. CARS.

In an article on the Economist, Craig credited the late Dave Kleiman as member of the team. I confirm Kleiman was a member of the team.

The death of Kleiman left the team somewhat unbalanced, and it played merry hell on the lives of those left in the team. It is no exaggeration to say that the Satoshi experience marked the people far more than could be appreciated from outside - they changed, their personalities flayed, their tempers tested, their lives turmoiled. Dave Kleiman died in suspicious circumstances, a story yet to be fully told.

Whatever, they are, they became, they suffered as different people, and I cannot say for better or for worse.

Satoshi Nakamoto was cryptography's best-kept secret since Enigma. For more than 6 years the secret was held by a tiny bunch of supporters ring-fencing around the team - for privacy, for safety, and for fear.

Sometime in summer of 2015 the secret started to spread, and the writing was on the wall. An extortionist and a hacker started attacking, perhaps together, perhaps apart; to add to the woes, Dr. Wright and his companies were engaged in a long harsh bitter battle with the Australian Tax Office.

Satoshi's various enemies are keeping mum on what they did, but it seems fair to say that the attackers conspired to attack Dr. Wright. On 8th December 2015, a clear result was found in the paparazzi days led by lowbrow gutter press, Wired and Gizmodo. These tabloids launched horrible attacks within hours of each other, and a couple of hours later the ATO raided both home and office - a clear sign of coordination.

Since then, the team has been more or less in hiding, guarded, at great expense and at some fear. Since then, the journalists and editors have one unified name: Mud.

Craig Wright left Australia shortly after and set up in a new location (disclosed as London) with new business, new corporation, new teams. Now that he has come out as the team leader, as the quintessential genius behind the team, a new chapter opens up.

But also closes - Satoshi Nakamoto dies with this moment. Satoshi was more than a name, it was a concept, a secret, a team, a vision. Now Satoshi lives on in a new form - changed. Much of the secret is gone, but the vision is still there.

Satoshi Nakamoto is dead, long live Satoshi.

Craig the man

Yet, a warning to all. Satoshi was a vision, but Craig is a man. The two are not equal, not equivalent, not even close. Which is why the team aspect is so important to understand, something the world will not appreciate for some time. It is true that Craig is the larger part of the genius behind the team, but he could not have done it alone.

Nor - as a warning - is the man the vision. Not even close. As you come to know Craig you will discover he is no legend, no God, no saviour. He's just a guy, a prickly one at that, he's a lot like those very difficult geek/nerd/blatherers that turn minor IT support into a social drama. In short, Craig is human, in that very way that Satoshi could never be.

This doesn't detract from the magnificence of history - that speaks for itself. But please, don't dump your visionary expectations onto one man. He's not up to it, you're not going to like the result, and it's inhuman.

Satoshi Nakamoto has died, yet long may Satoshi live. Now we really are Satoshi, now you all are. There is no longer any excuse, we each in every way are responsible for taking the vision forward.

Posted by iang at May 2, 2016 05:49 PM

http://financialcryptography.com/mt/archives/001593.html

The Satoshi Affair

Andrew O’Hagan on the many lives of Satoshi Nakamoto

30 June 2016

London Review of Books

https://www.lrb.co.uk/v38/n13/andrew-ohagan/the-satoshi-affair

The Raid

Ten men raided a house in Gordon, a north shore suburb of Sydney, at 1.30 p.m. on Wednesday, 9 December 2015. Some of the federal agents wore shirts that said ‘Computer Forensics’; one carried a search warrant issued under the Australian Crimes Act 1914. They were looking for a man named Craig Steven Wright, who lived with his wife, Ramona, at 43 St Johns Avenue. The warrant was issued at the behest of the Australian Taxation Office. Wright, a computer scientist and businessman, headed a group of companies associated with cryptocurrency and online security. As one set of agents scoured his kitchen cupboards and emptied out his garage, another entered his main company headquarters at 32 Delhi Road in North Ryde. They were looking for ‘originals or copies’ of material held on hard drives and computers; they wanted bank statements, mobile phone records, research papers and photographs. The warrant listed dozens of companies whose papers were to be scrutinised, and 32 individuals, some with alternative names, or alternative spellings. The name ‘Satoshi Nakamoto’ appeared sixth from the bottom of the list.

→ read all 35615 words

The Bitcoin Doco

Craig Wright interview

Just recently (8.12.2015) Wired published an article stating they had evidence that suggested an Australian man, CraigWright, was Satoshi Nakamoto., the creator of bitcoin. For #TheBitcoinDoco we interviewed Craig at Melbourne's Bitcoin conference July last year. Since we started the documentary there has been a phenomenal amount of movement with Bitcoin:

*Ross Ulbricht was found guilty of being a drug kingpin for creating and running the Silk Road website. One of his moderators, an Australian was shipped to the states, then released 9months later. Ross was sentenced to double life in prison, his parents are currently fighting for a retrial and are as you can imagine are highly stressed, his mother had a heart attack 30October. They had no idea he was involved with drugs at any level and are doing what they can to release him from the sentence.

*MtGox collapsed, many people held their breath to see how it would affect Bitcoin, which turned out to be not really that much considering the amount of trade the CEO Mark Karpeles was pretending to manage. Bitcoin didn't die the death skeptics predicted, if anything it grew stronger, the price dropped and kind of flattened out for a long time while the focus switched to a newest biggest buzz word "blockchain."

*Banks started to love the idea of Bitcoin, they even sponsored Sydney's 'blockchain' event. It started to become obvious big names in the financial sector didn't want to associate their business with anything 'bitcoin'. Experts were hired to work out how they could use the blockchain to their advantage... something like a global database keeping cross payment functionality. Projects were dropped as the realisation hit that bitcoin and the blockchain are inseparable, one exists for the purpose of the other. Despite these discoveries, Bitcoin continues to grow and prove more of a threat to the existing monetary system.

*Governments around the world started to take Bitcoin seriously when the reality of how the technology works hits home, various licenses were created, laughed at, dropped, reconfigured and bitcoin businesses moved jurisdictions so they could continue to stay true to the bitcoin protocol. As censorship rears its ugly head more decentralised networks are being thought out and acted on, and laws are changing in an attempt to encompass our ever expanding digital world.

*Maidsafe is creating a network based on computers and a system for people to 'uber' the network, people will be rewarded based on reputation, participation, services... facilities for trading will also be available. It's been worked on so far for 9 years, people can experiment with it from the safenetwork forum as releases are made,

*Melbourne's bitcoin scene has spread into various areas via people following their unique passions, the bitcoin center has grown through some often dramatic ideologies to formulate into a unique space. Last year they had 4 RMIT (university) students participate for a semester to learn about cryptocurrencies, 2 of them worked on a safenetwork project and 2 on CryptoGoss, a fortnightly podcast. The experience was a success, both parties were so satisfied with the result that next year 14 students will be learning about cryptocurrencies from 4 different projects. The space is thriving into an education center.

*TheBitcoinGroup are STILL working hard to get listed on the Australian stock exchange. They'll be the first compnay in the world to follow all necessary procedures, tick all the boxes and continually bump heads with ASIC, Australia's regulators who are not quite sure what it is and are asking many questions.

These are just a few examples of what's happening in the dynamic, constantly morphing cryptocurrency space. Episodes 1 and 2 capture some of this growth in interviews with other key people around Australia.

Imagine our surprise when it was suggested that Craig was SatoshiNakamoto! Shortly after the release of the article his online presence started to disappear, video's and blogs gone, and a variety of stories started to crop up... apparently he paid $84.25 million with bitcoin for gold and software. The tax agency raided his home 2 hours after the article was published and experts started to crop up with #ProofOfNothingReally.

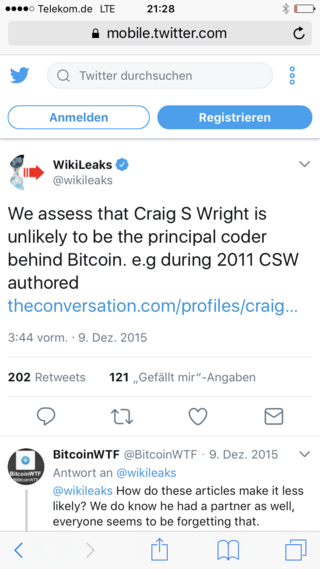

The main article said he could have leaked his own information, a hoax has been called... yet Wikileaks reconfirmed Craig wasn't the principal coder, does that suggest Craig was somehow involved? Another article shared about the expertise required for some major projects. It implied Bitcoin is a 20 year project in the making and Craig 'brought it home' so to speak.

Chris and Dale watched the video again, looked at each other with "could go either way." and came to the conclusion that regardless of who he is, the real life examples of how Bitcoin could possibly work, in a peer to peer work are pretty awesome.

What do you think - is he, isn't he... and does it even matter anymore?

Source: https://vimeo.com/149035662

Wikipedians on Greg Maxwell in 2006 (now CTO of Blockstream): "engaged in vandalism", "his behavior is outrageous", "on a rampage", "beyond the pale", "bullying", "calling people assholes", "full of sarcasm, threats, rude insults", "pretends to be an admin", "he seems to think he is above policy"…

Source:

reddit.com/r/btc/

Ian Grigg announces that he nominated Satoshi Nakamoto for the acm AM Turing Award

Published by Coinscrum on 12.12.2015

Recorded by Proof of Work Media London 2015

Source:

https://youtu.be/zxbNm-Ay67g

The resolution of the Bitcoin experiment

Published by Mike Hearn on Jan 14, 2016

[...]

From the start, I’ve always said the same thing: Bitcoin is an experiment and like all experiments, it can fail. So don’t invest what you can’t afford to lose. I’ve said this in interviews, on stage at conferences, and over email. So have other well known developers like Gavin Andresen and Jeff Garzik.

But despite knowing that Bitcoin could fail all along, the now inescapable conclusion that it has failed still saddens me greatly. The fundamentals are broken and whatever happens to the price in the short term, the long term trend should probably be downwards. I will no longer be taking part in Bitcoin development and have sold all my coins.

Why has Bitcoin failed? It has failed because the community has failed. What was meant to be a new, decentralised form of money that lacked “systemically important institutions” and “too big to fail” has become something even worse: a system completely controlled by just a handful of people. Worse still, the network is on the brink of technical collapse. The mechanisms that should have prevented this outcome have broken down, and as a result there’s no longer much reason to think Bitcoin can actually be better than the existing financial system.

[...]

Source:

https://blog.plan99.net/the-resolution-of-the-bitcoin-experiment-dabb30201f7

Craig Steven Wright

Chief Scientist

Private, July 2015 – Present (6 months)

Writing papers,

Research,

Managing change.

Nothing but security and blockchain

Gregory Maxwell, whom I have known for many years as a Wikipedian and have always found to be a reliable person, is a notable bitcoin core developer. He has written extensively in threads on reddit as to why he thinks this is not true.

Foremost in his evidence is that the PGP keys which allegedly tie Wright to Nakamoto are not convincing.

First, they are alleged to have been created at a certain point in time, but there are good reasons to think not. No one has found a source for the key in logs from that time, and the ciphers used to create the key were either not common at the time or not in existence at the time. It is trivial to forge the creation date on a PGP key (just set the clock on your computer back). So if you were trying to fool an unsophisticated reporter, this would be a good trick to try.

Second, one of the keys is linked to an address very similar to a known Nakamoto email address, but which is generally unknown to have ever been used by Nakamoto.

You can find more details in Gregory's reddit posting history, overview for nullc .

Human rights and property

Posted by Craig Wright at Friday, October 23, 2015

The most fundamental of human rights is the right to hold property. There are many who would argue this but the reality is to be free we need to be able to control our lives. To choose how we wish to live and not be beholden to others we need to ensure that we follow a path that we control ourselves. To do this and to live our lives freely we need to be able to control our property and ensure the security and integrity of those rights.

Freedom is the core of what bitcoin and the Blockchain is about. My team and I have been working for several years now on solutions to the issue of property. In the coming months, we will be releasing several papers and solutions to what we see is the problem with the state of the financial system, property and risk transfer.

The primary concern is we see it is the volume of information people can find out about ourselves. Our lives are not private, and they are becoming less and less private over time. This lack of privacy is not about protecting criminal acts but rather empowering the individual to live the life they want to live.

We have been working on redeemable contracts. Our solution is the creation of a form of tradable, secure property rights that have been abstracted from the individual and the use.

An example would be a property title for a house. Because you live in a house does not mean people need to know that you own it. In time, our solution will allow you to separate the ownership and occupation and use of any property. In this example, we divide the ownership of the house into shares that are tradable but that link over the Blockchain to redeemable contracts that are encrypted and stored in a distributed manner across the Internet.

The solution will include a secure voting system and a revenue distribution system. This will allow a homeowner to pay rent on their home at market rates. The rent will be distributed to the property under the shares. Where the homeowner owns 100% of the house, the money will be pseudonymously returned to them.

If they need to raise capital, as an owner of shares in their property, they can sell these on a tradable market. The purchaser of those shares will then retain dividend rights under the lease terms. We will be releasing details of the system shortly in coming months.

In this manner, the homeowner can separate the property rights from the residential rights and reside in a property that they own while not publicly releasing the fact that they own the property. Further, a property owner can reduce the risk of owning a property by sharing the ownership. They could, for instance, exchanged 30% of the shares in their home for shares in other properties. In the event that they owned 100% of their home, the rental income from the other properties would pay for their rent repayments without interest while at the same time allowing them to diversify and reduce the risk of what is arguably the largest investment they will have in their life.

This system will be able to be scaled and will be distributed. It will allow people in repressive countries to move funds and save capital and invest for their future and that of their children. Most importantly those of us who live frugally and don't want people knowing what we have can invest and save without being ostracised and without having to worry about the property we own being taken from us.

In any transfer, a record will be kept. This record will include predation by governments in those countries that do not respect property rights or the rights of the individual.

Our work is far from over, and most of you don't know anything of what I've done. In the coming months, we will be publishing a series of papers documenting the research we have been conducting. There is a reason we have been building supercomputers and hasn't been bitcoin mining. Going forward, it is important that we create the world where people can live their lives as they choose as long as they don't impact on the rights of others.

This involves ensuring that we have the right to save and control our futures without fearing predation. The right to a future without loss caused by the theft of others. The right to live silently if we so choose. The right to invest and make a better world and not be held in contempt for that.

The results of this research is what Bitcoin and the Blockchain are about. A free system to transfer and maintain property.

Source:

https://archive.is/szi4o

Alleged Inventors of Bitcoin Uncovered

Published by Gizmodo on 8 Dec 2015

According to a cache of documents provided to Gizmodo which were corroborated interviews, Craig Steven Wright, an Australian businessman based in Sydney, and Dave Kleiman, an American computer forensics expert who died penniless in 2013, were involved in the development of the digital currency Bitcoin.

Read more: http://gizmodo.com/this-australian-sa...

We come from the future.

https://gizmodo.com

All-Star Panel: Ed Moy, Joseph VaughnPerling, Trace Mayer, Nick Szabo, Dr. Craig Wright

Bitcoin Investor Conference - Las Vegas, NV Oct. 29 - 30, 2015

Source:

https://www.youtube.com/watch?v=LdvQTwjVmrE

Top Bitcoin Core Dev Greg Maxwell DevCore: Must watch talk on mining, block size, and more

Published by The Bitcoin Foundation on 9 Nov 2015

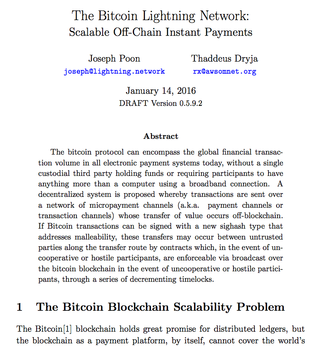

Joseph Poon & Thaddeus Dryja present:

How to make Bitcoin capable of handling the volume of all global electronic payments on a single blockchain without custodial risk of theft.

The Slides: http://lightning.network/lightning-ne...

The Paper: http://lightning.network/lightning-ne...

Mike Hearn - Blocksize Debate At The Breaking Point - EB82

Published by Epicenter Podcast on 08.06.2015.

Whether the block size should be increased to 20MB has created more controversy than any other question in Bitcoin's recent history. For some, it is an urgent and necessary step in Bitcoin's evolution. Their view is that leaving the block size at 1MB would be irresponsible inaction with potentially catastrophic consequences. Others see increasing the block size as unnecessary and a dangerous first step down a slippery slope towards a more centralized Bitcoin.

We were joined by Mike Hearn, along with Gavin Andresen the most outspoken supporter of a block size increase. He is also the creator of Bitcoin XT, a modified fork of Bitcoin Core, that may become the vehicle for the push for bigger blocks if no agreement is reached regarding Bitcoin Core. Don't miss this crucial conversation!

Topics included:

- What would happen if blocks started being consistently full

- Whether bigger blocks create a centralization risk

- Why Bitcoin core development has become pervaded with toxic division

- What Bitcoin XT is and how it differs from Bitcoin Core

- The roadmap ahead and how a transition to BitcoinXT would occur

- Update on Lighthouse

Links mentioned in this episode:

Source:

https://youtu.be/8JmvkyQyD8w

Edward Snowden on Bitcoin

Transcript of Edward Snowden's comments at IETF 93 Prague Meeting in July 2015

[...]

So, the Bitcoin thing is – I mean this is – nobody really likes to talk about Bitcoin anymore. There are informed concepts there. Obviously, Bitcoin by itself is flawed. The protocol has a lot of weaknesses and transaction sides and a lot of weaknesses that structurally make it vulnerable to people who are trying to own 50 percent of the network and so on and so forth.

But when we think about the basic principles behind it, there are some very interesting things that particularly when we start to combine them with that idea like before of tokenization, of concepts like proof of work.

Are there other means through which people can basically pay for access other than direct transfers of currency that originated with an association to their true name?

The other ones are inaudible mixed in networks, for example, where we have multiple steps just like Tor where they got these mixed inaudible in the Bitcoin universe where they tumble the transactions of the Bitcoins that go in it to pay for your purchase aren't the same Bitcoins that go out.

But focusing too much on Bitcoin, I think, is a mistake. The real solution is again, how do we get to a point where you don't have to have a direct link between your identity all of the time? You have personas. You have tokens that authenticate each person and when you want to be able to interact with people as your persona in your true name, you can do so. When you want to be able to switch to a persona - a common persona, an anonymous persona, a shared persona, you can do that. When you want to move to pseudonymous persona, you can do that.

A lot of these are difficult problems particularly when we talk about the metadata context, the signalling context. And there are actually some really bad proposals, I think, and this is in no offense to anybody who works on these particular problem spaces, but again, it gets back to the middlebox space.

We've got proposals like SPUD, for example, where they wanna make UDP a new channel for leaking metadata about the user's intention.

[...]

Source:

https://gist.github.com/

Hapori YC Fellowship Application Video

Published by Clemens Ley on 27 Jul 2015

Hapori is like Reddit but you get bitcoin if you contribute value.

It works like this:

- Like on Reddit you can submit links and up-vote them (there are no downvotes though.)

- Unlike on Reddit each up-vote is an investment in a post. You invest the equivalent of a few cents in a post and that money goes to the person who submitted the post and everybody who up-voted before you.

- Submitting links and comments is free (but you will make money if your post gets upvoted).

- Thus you can make money by either submitting a post that gets many upvotes, or by up-voting a post that many users up-votes after you. If you amoung the last people to vote on a post you will lose money.

- Obviously mods contribute a huge amount of value to an open platform like Hapori, and according to our mission we'll give them bitcoins. Details are yet to be worked out, but we are likely to give them a share of the advertising revenue that their community generates.

Source:

http://hapori.io/

I have been staring at my screen for hours, but I cannot summon the words to express the depth of my gratitude to those that have supported the bitcoin project from its inception – too many names to list. You have dedicated vast swathes of your time, committed your gifts, sacrificed relationships and REM sleep for years to an open source project that could have come to nothing. And yet still you fought. This incredible community’s passion and intellect and perseverance has taken my small contribution and nurtured it, enhanced it, breathed life into it. You have given the world a great gift. Thank you.

Be assured, just as you have worked, I have not been idle during these many years. Since those early days, after distancing myself from the public persona that was Satoshi, I have poured every measure of myself into research. I have been silent, but I have not been absent. I have been engaged with an exceptional group and look forward to sharing our remarkable work when they are ready.

Satoshi is dead.

But this is only the beginning.

Craig S Wright

DevCore Boston 2015 l What Satoshi Didn't Know l Gavin Andresen, Bitcoin Foundation

Published by The Bitcoin Foundation on 11 Mar 2015

Bitcoin

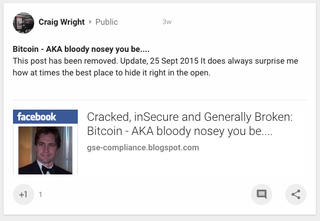

Posted by Craig Wright at Thursday, September 10, 2015 on gse-compliance.blogspot.com.au

The attitudes of many people today come from the fact that they have not been involved in the beginning of anything. In my case, much angst in my past right until the recent present has been a result of bureaucrats and government officials pontificating on the way an ideal business should be started.

In growing from nothing to where we are now we have cut many corners. This is allowed us to go from and ownership of assets audited in the thousands of dollars that had become worth many many millions.

In this process we have dealt with a number of organisations but some would consider shady. I've dealt with people who are far worse. The interesting thing however is that so-called respectable organisations have also dealt with the same entities.

Between 2010 and 2013 we dealt with Liberty Exchange rather extensively. We had dealt with Web Money in the Russian Confederates but though they did manage the system and return the value of the money they had, there is always something a little untrustworthy with them.

Up until early 2013 when the US government closed Liberty Exchange, they were one of the most efficient money transfer organisations in the world. More, they were far more secure than Mount Gox. Having lost monetary funds held in trust within Mt Gox, for all the irregularities with Liberty, if it was not for their takedown by the US government I'd still be using them.

It's really a control factor. The thing is it's not about money like everyone says all the bad things that people do. It is about control.

The biggest issue with a distributed currency and the nature of bitcoin is that it is not controlled.

The Japanese have a consensus-based culture. The result of this is that they have developed many ways of saying no without ever saying no. When they actually agree, you know it. But when they choose not to do something they don't actually say no. They have elaborate ritual ways of saying that they will look into things or consider them and spend a long time skirting the issue.

It's a model for governance and government that I like. Things are either done or they go into a black hole. The model of debating alternatives that we see now in many Western cultures does not occur. The same thing occurs with the consensus model in bitcoin. In some ways it's very Japanese. But not the Japanese that people seem to recognise.

The term bushido only came about in the 1890s. Most people do not seem to realise this. It was actually an obscure word that had hardly been used in any writings in Japan between 1300 on. Yet the fanciful writings of a Japanese scribe reminiscing the world of his grandfather had become the Western idea of what a warrior in Japan had as their ideals.

Some of the greatest Japanese stories are of people who did not fight to the death but rather decided to live to fight another day. Their loyalty to their Lord and task was stronger to the ideal of what they followed than it was to their own personal honour.

In getting to where we are now, a little-known organisation that runs the largest supercomputer in the southern hemisphere and has been researching crypto currencies from a time when people joked about my interest derisively to now we have dealt with many strange organisations.

Some of the hosting companies we have used a best known for hosting quasi-legal coupon-were, pornography and anonymous VPNs outside of US jurisdiction.

Moving forward, we are looking at building new data centres in Iceland and Switzerland and all of these will be done with a far greater level of legitimacy. But in the past, when we approached providers such as Dell may effectively laughed at us. A small organisation trying to sell a few million dollars worth of bitcoin to buy computers was not even good enough to be a joke.

I started a Facebook page and paid for advertising a few years ago because of some of these issues. I had one called "Dell sucks for service". In many ways they did.

We ended up using SGI through a provider in Panama were been using a number of anonymous VPN services for years as they would actually take bitcoin through Liberty Exchange in 2012. I don't know of another provider who would. Dell even laughed at the idea of receiving money through Liberty exchange or negotiating the deal for that matter let alone taking it in bitcoin. So given the options is not about who the regulators decide is best with who can deliver in business.

Yes, this is led to us dealing with several fraudsters who have taken many millions of dollars in cash in bitcoin over the years. Not too proud to admit this. I don't like it, but it is a fact of life.

But for all the protections that government reports to offer us that would have stopped one of two out of the many frauds we have faced, none of the protections would have first of all protected us from the larger ones and more importantly they would have simply stifled any innovation within the organisation. If we had simply waited to develop new applications and solutions we would have done nothing.

The interesting part though is that one of the largest frauds we faced was conducted by a person whose records were perfectly clean despite having a bankruptcy and 37 convictions. ASIC managed to appoint him as a director validly on a company here in Australia even though he wasn't allowed to be one, the company address was fake, any other information was fabricated.

See can forgive me if I put little sway to the benefits of regulation.

Source: archive.org

Bitcoin Belle on the Ulbricht Case and the Silk Road – YMB Podcast E56

YMB: Your Liberty & Bitcoin Podcast, January 23, 2015

Today we're joined by a very special guest, Michele Seven, also known as the Bitcoin Belle. She's been heavily involved in the activism surrounding the trial of Ross Ulbricht, the alleged creator of the Silk Road. Many people dislike the idea of an underground marketplace, but Michele will share some powerful experiences from her own life to explain the importance of having a safe environment for people buying drugs.

Source: youmeandbtc.com

There's a [crypto] sex bias in the bitcoin world

Ian Grigg Networks With IamSatoshi.

Posted by Satoshi Pollen on 08.02.2015

JavaScript is turned off.

Please enable JavaScript to view this site properly.